INVESTORS

Invest in our growth and delivery of our exceptional pipeline of profitable development schemes throughout England and Scotland. Before offering any opportunity to invest you can be assured that Kapital have assiduously researched all the opportunities and secured sites at good prices in areas with a shortage of residential accommodation and where local councils are behind on their annual house building targets. The senior management at Kapital have a proven track record of delivering exceptional residential schemes and mixed use projects over a 35 year period. The team have successfully completed and exited over £1billion of residential and mixed use property development schemes across a more than one hundred separate projects, ranging from a single mansion house to new communities of more than 400 homes, including hotels and a marina.

“Living the dream – one of the nicest developments I have ever seen.”

“These are wonderful new homes.”

“I am so delighted to see how the building has been transformed back to its original glory. What an asset to Scotland! Congratulations on an incredible achievement and good luck with the future of this amazing landmark building”

“Working with Keith delivered an exceptional return for our farming partnership. Before he was involved we had been recommended to accept much lower bids but, within four months, Keith delivered financial gains exceeding more than one third more for us, and on better terms, by acting on our behalf in the sale of 24 acres to a national housebuilder”

“Kapital were very straightforward to deal with, we concluded a purchase of land sufficient for 220 plots which we have now secured detailed consent for, and we have also agreed on the acquisition of a further 80 acres”

“Living the dream – one of the nicest developments I have ever seen.”

“These are wonderful new homes.”

“I am so delighted to see how the building has been transformed back to its original glory. What an asset to Scotland! Congratulations on an incredible achievement and good luck with the future of this amazing landmark building”

“Working with Keith delivered an exceptional return for our farming partnership. Before he was involved we had been recommended to accept much lower bids but, within four months, Keith delivered financial gains exceeding more than one third more for us, and on better terms, by acting on our behalf in the sale of 24 acres to a national housebuilder”

“Kapital were very straightforward to deal with, we concluded a purchase of land sufficient for 220 plots which we have now secured detailed consent for, and we have also agreed on the acquisition of a further 80 acres”

Hilton Garden City, Rosyth, Fife

Acquired agricultural site of 30 acres in 1999 (former brown field) for long term hold, promoted site in early 2009 for successful

Castle Toward Estate, Argyll

Site was acquired without the benefit of any planning permission (other than as school) and immediate works were carried

COMING SOON

MANCHESTER

Opportunity to finance Kapital Development UK Ltd in its growth and delivery of its exceptional pipeline of profitable development

COMING SOON

LINCOLNSHIRE

Opportunity to finance Kapital Development UK Ltd in its growth and delivery of its exceptional pipeline of profitable development

Who We Are

Kapital Development is a private investment platform led by Keith Punler, a highly experienced and award winning developer, who has delivered over £1 billion of real estate revenue for his businesses.

We create new homes and communities throughout the UK, and have undertaken over one hundred separate projects, ranging from one off multi million pound mansions in Surrey to new communities of over 400 new homes in Aberdeenshire, Fife and the Scottish Borders.

Our venture supporting SME housebuilders in their land acquisitions journey addresses the roadblocks currently hindering development sites across the UK. We engage with housebuilders at various stages and have crafted two distinct strategies:

– Immediate acquisitions: Ready to immediately invest in opportunities needing a planning overhaul, like converting commercial to residential or acquiring distressed assets direct from (or partnering with) vendors, banks or liquidators. We also acquire strategic land and then work with our delivery partners transforming these projects into new homes and communities

– Partnerships: Aiding SME housebuilders with growth plans through our JV partnership model, bridging equity gaps and working closely with them to adapt and evolve their business structures allowing them to grow rapidly.

Areas of expertise

STRATEGIC LAND AND MASTERPLANNING

STRATEGIC LAND AND MASTERPLANNING

We acquire strategic land in a variety of ways, from outright purchase through to acting in a promotional capacity in partnership with landowners.

Our primary aim is to maximise the value of land that we identify as being suitable for future development and we maximise profitability for our clients in an open book way by advancing the sites through the consent process and then developing out the sites ourselves or by taking them to the open market.

We have created several new communities each in excess of four hundred units complete with associated commercial, retail and hospitality offerings.

Recent deals have included the sale of 220 plots to Cala Homes, 170 plots to Avant Homes and concluding option agreements with a national housebuilder over parcels exceeding 100 acres

DISTRESSED ACQUISITIONS

DISTRESSED ACQUISITIONS

We acquire distressed assets throughout the United Kingdom — those assets that are in an adverse financial situations through bankruptcy or foreclosure, and we repurpose those assets to create added value. We will consider acquiring the assets, or in some cases the troubled businesses.We work with companies, lenders, administrators and liquidators by deploying immediate capital and reworking the strategy, and wherever possible will offer solutions that avoid the consequences of liquidation or bankruptcy

CHANGE OF USE OPPORTUNITIES

CHANGE OF USE OPPORTUNITIES

We look at opportunities to repurpose buildings, to create additional value by bringing a change of use. We have acquired commercial and leisure buildings, offices and hotels, turning these into residential properties.ACQUIRING SITES FOR OUR JV PARTNERS

ACQUIRING SITES FOR OUR JV PARTNERS

As part of our partnership model with our development partners, we will acquire fully consented sites to provide a deal pipeline for them to undertake. By setting ambitious growth targets for our partners, we recognise that high quality “oven ready” development sites are often required.

Do you wish to be considered as one of

our joint venture partners

Do you wish to be considered as one of our joint venture partners

If you are a landowner and have either consented land or strategic land we want to hear from you, we can help unlock your sites potential. Similarly if you have a development/housebuilding business and have ambitions to grow it to one of scale, become one of our joint venture partners to realise your goals.

We engage in partnerships and collaboration opportunities with carefully selected delivery partners throughout the United Kingdom. These are limited partnership opportunities available to experienced developers only.

If you are poised to propel your business to new horizons, we are eager to hear from you.

With a wealth of over 35 years in the industry, coupled with extensive entrepreneurial acumen and financial support to bolster your endeavours, we aspire to embark on outstanding property projects together. You will spearhead these ventures while benefiting from our mentorship and financial backing. Our approach eschews seeking equity participation in your business; instead, we emphasize project-driven rewards, placing emphasis on delivering exceptional developments. The linchpin to our success lies in having an experienced partner with readily available funds to deploy.

Who we are seeking:

What we are not seeking:

Get in touch with us, we would love to hear from you! info@kapitaldevelopment.co.uk

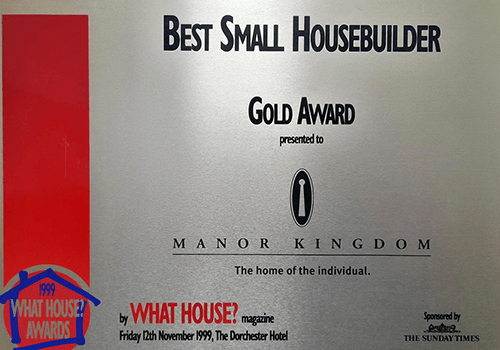

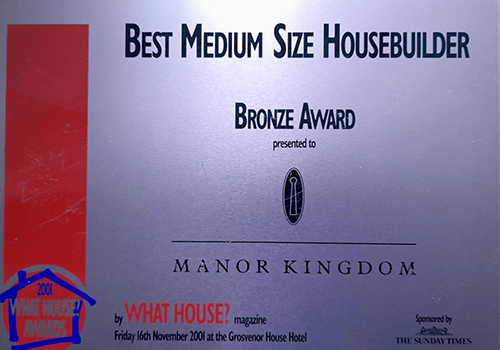

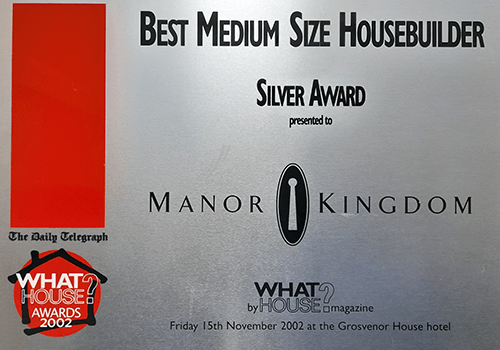

Awards

The CEO of Kapital is award winning and has accumulated

29 national awards in the building industry.

Keith Punler, the CEO of Kapital Development UK is a vastly experienced and award winning entrepreneur with an astonishing track record of successful business and property development spanning the last thirty five years, directly generating and delivering over £1 Billion of revenue for his businesses.

At the age of twenty two Keith founded his first business which went on to become one of the UK’s most successful luxury housebuilders. The company was accoladed with twenty nine national awards in nine years including Bronze Award Winner in the British House builder of the Year 1998; What House? 1999 Gold Award winner; Silver Award in the British House builder Awards 2000; Gold Award in the British House builder Awards 2001; What House? 2001 Bronze Award Winner; What House? Best Medium Sized House Builder 2002; What House? Best Luxury House 2002; Silver Award in the British House builder Award 2002; Building Awards 2002.

He was also awarded the Association of International Property Professionals International Developer of the Year in 2007 for his overseas work, and has twice been accoladed with the EY Entrepreneur of the Year

Keith is known for implementing unique strategies to grow his businesses rapidly and successfully. In the early years he worked with and learned from two of the world’s leading bespoke automotive and luxury yachting companies, allowing him to develop his business with an award winning vertical integration strategy, directly controlling its supply chain, establishing a large manufacturing facility in Fife, where it adopted Modern Methods of Construction to reduce site activities and increase factory controlled quality production.

He was also awarded the Association of International Property Professionals International Developer of the Year in 2007 for his overseas work, and has twice been accoladed with the EY Entrepreneur of the Year

Keith is known for implementing unique strategies to grow his businesses rapidly and successfully. In the early years he worked with and learned from two of the world’s leading bespoke automotive and luxury yachting companies, allowing him to develop his business with an award winning vertical integration strategy, directly controlling its supply chain, establishing a large manufacturing facility in Fife, where it adopted Modern Methods of Construction to reduce site activities and increase factory controlled quality production.

The Team

CHIEF EXECUTIVE OFFICER

KEITH PUNLER

A qualified Quantity Surveyor by trade with a range of projects successfully completed on budget; including, notably, a very detailed defence project with a budget of over £440m of costs.

Entrepreneurial professional with enviable track record who has operated at board level for 25 years in private and public sectors.

Has held executive and senior management positions across a diverse portfolio of industries including retail, tourism, leisure, aviation, manufacturing and of course construction and property.

Experienced in optimising and delivering a range of different types of development schemes, including Greenfield sites, Brownfield sites, residential homes, and mixed use schemes.

Founded, developed and successfully sold award winning housebuilding company achieving £45m annual turnover.

Successful history in securing high quality planning approvals, and working closely with local government councils to ensure schemes are attractive and viable.

CHIEF FINANCE OFFICER

FRASER NIVEN

An experienced CEO and CFO with a strong background in auditing, finance, and operational leadership. Originally specialising in auditing with PwC and Halifax, Fraser has gone on to lead complex businesses across multiple sectors in both the UK and US.

He spent ten years as CEO of Hamilton and Kinneil Estates, where he managed commercial and business interests across six operating companies on behalf of the Duke of Hamilton and his family. During this time, he secured $40 million in investment for The Renaissance Club at Archerfield and successfully completed over £15 million in land and property disposals.

Fraser is highly skilled in strategic change, performance management, finance raising, mergers and acquisitions, and stakeholder engagement. He is recognised for his negotiation abilities and collaborative leadership style.

In 2014, Fraser founded FIN Management, an ICAS-regulated accounting firm delivering financial services across a range of industries. Notably, he served as CFO of a global media-tech business, where he helped raise over £4 million through private investors and EIS, and strengthened investor relationships while developing comprehensive financial controls and reporting systems for a SaaS-based operation.

Earlier in his career, Fraser was Managing Director of various SMEs across sectors including hospitality, mining, furniture, and wine wholesaling, giving him a well-rounded commercial grounding.

NON-EXECUTIVE ADVISOR

STEPHEN O’BRIEN

A highly experienced director with over 30 years in the property and development sectors, known for his strategic thinking, turnaround expertise, and impressive track record in high-value dealmaking.

He successfully led the turnaround and management of a hospitality and property business valued at £15 million during the COVID-19 pandemic. Over the course of his career, Stephen has completed 17 funding deals, including acting as principal in several arrangements, securing approximately £33 million in total funding. These efforts have delivered gross returns exceeding £7.3 million, with individual returns ranging from 12% to over 200%.

Among his notable achievements, Stephen developed and managed a Grand Prix event that was nominated for a Scottish Marketing Award. From 2004 to 2019, he was involved in a specialist development company — the only one of its kind to successfully navigate the credit crisis while delivering small residential housing projects.

Stephen is recognised for his deep understanding of business strategy, investor relations, and financial structuring. Over his career, he has generated £300+ million in business and achieved an impressive internal rate of return (IRR) of 12.5%, outperforming the industry benchmark of 11%.

Project Director (Southern)

RICK HILTON

Bio coming soon.

Project Director (Northern)

KEITH MCNAIR

Bio coming soon.

ADMINISTRATION DIRECTOR

SARAH GREEN

Sarah is a highly organised and experienced Executive PA with over 10 years in finance, property, banking, and customer-focused roles.

She is responsible for all business administration, systems management, and process improvement, with recognised management qualifications and a creative, solutions-focused approach to supporting senior leadership.

Known for building efficient workflows, managing sensitive information with discretion, and keeping high-level operations running smoothly behind the scenes.

Combines excellent communication skills with a sharp eye for detail, ensuring that nothing slips through the cracks, whether it’s diary management, document control, or stakeholder coordination. Sarah co-ordinates all communications with our partners and investors

ABOUT KEITH PUNLER

Kapital Development UK Ltd | Registered in Scotland SC841951